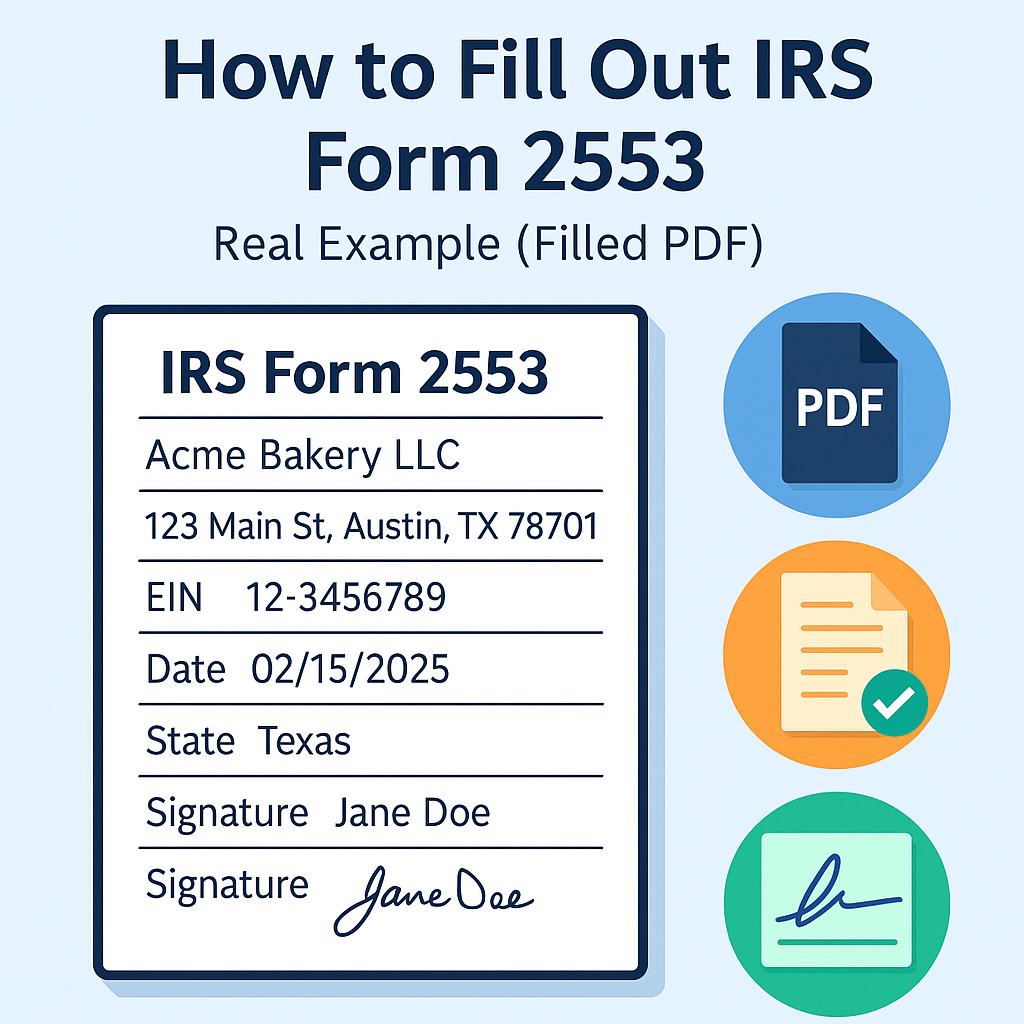

How to Fill Out IRS Form 2553: Real Example (Filled PDF)

Electing S Corporation status with the IRS can save your business thousands in taxes, but only if you fill out Form 2553 correctly. Many business owners are overwhelmed by IRS forms—so here’s a real, filled-out example of Form 2553, plus step-by-step instructions to make it easy in 2025!

Download Example Filled 2553 PDF (Free)

IRS Form 2553: Quick Recap

Form 2553 lets your business elect S Corporation tax treatment. This affects how your business pays taxes and can help avoid double taxation. For a full explanation, see our Step-by-Step Guide.

Step-by-Step Instructions – Example for 2025

Let’s walk through the main sections of the form, with a real-world example for “Acme Bakery LLC”, a small business based in Texas, filing in 2025.

| Form 2553 Field | Example Entry | Explanation |

|---|---|---|

| Name | Acme Bakery LLC | Full legal business name |

| Address | 123 Main St, Austin, TX 78701 | Principal place of business |

| EIN | 12-3456789 | Employer Identification Number from IRS letter |

| Date incorporated | 02/15/2025 | Date your business was legally formed |

| State incorporated | Texas | Your business’s state |

| Effective date | 02/15/2025 | Date you want S Corp status to start (usually same as incorporation if filing on time) |

| Tax year | Calendar year | Most businesses use calendar year |

| Shareholder names & signatures | Jane Doe (owner) Signature: Jane Doe | All shareholders must sign and date |

| Contact phone | (512) 555-1234 | Phone number for IRS questions |

| Late election explanation | (blank) | Only fill if you are filing late |

Download a Realistic Example (PDF)

Need a sample PDF to use as a template? Click here to download a filled-out Form 2553 (example). Replace all info with your business’s actual data!

E-sign & Send Your 2553 Instantly (IRS Compliant)

Tips for Filling Out IRS Form 2553

- Always use your official business name and address (as registered with the IRS).

- Double-check your EIN and formation date—typos cause delays.

- All shareholders must sign; e-signatures are accepted by the IRS in 2025.

- Mail or fax to the correct IRS address (see official instructions).

- If you’re filing late, complete the Reasonable Cause Statement in Part IV.

Common Mistakes to Avoid

- Leaving any field blank (unless marked optional)

- Wrong EIN or business name mismatch

- Missing signature from any shareholder

- Using blue ink instead of black for handwritten forms

- Forgetting to attach required statements if filing late

FAQ: Example Scenarios

- Q: Can I file Form 2553 online?

- A: As of 2025, the IRS allows e-signature and fax/mail submission. Check the IRS site for any e-file updates.

- Q: What if I only have one owner?

- A: That’s fine! Single-member LLCs can elect S Corp status; just fill out as above.

- Q: How soon will I hear back from the IRS?

- A: You’ll usually get a confirmation letter within 60-90 days.